Louis XIII and You

I am not, by any stretch of the imagination, what you might call a “drinker”. My average alcohol consumption per year is probably equivalent to no more than 3 beers total. But there is an aspect of the making of spirits which I find endlessly fascinating, and which has direct relevance to investing in cryptocurrencies, it is the brewers understanding of the magic of the fourth dimension, time.

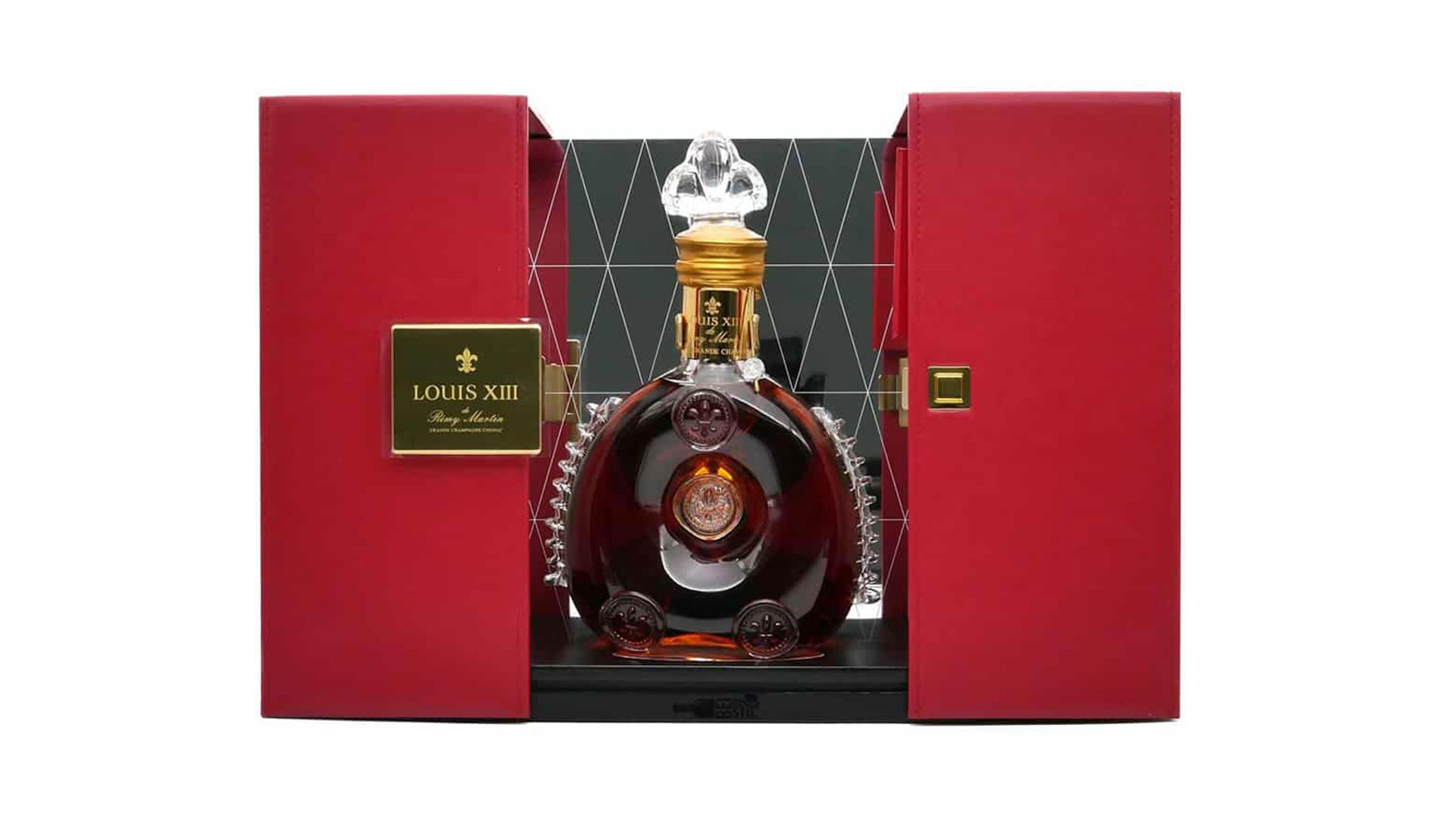

I recently had a chance to savor a few drams of Louis XIII cognac, one of the best in the world. It is an experience often ritualized, meant to be enjoyed slowly, taking the time to savor and feel the spirit, to let it overwhelm your senses. Of course I am not qualified to really give a review of Louis XIII, I am not a connoisseur, but I can tell you that great part of the fun of drinking it comes from telling the story:

Louis XIII is made in France in the Grand Champagne region, by the same House and with the same techniques for the past 300 years or so. Allowed to mature in 150 year old barrels for periods of no less than 40 years and up to and beyond 100 years, you would be surprised to know that the “Cellar Master” who supervises the distilling and aging of this cognac, may never get to taste the matured fruits of his labor. After all, 40 years, the minimum amount of time the component parts of this cognac are aged for, is the average working lifetime of your average human being today.

Let that sink in for a moment, the man charged with blending and maintaining the quality of this cognac, will likely never taste the product of his efforts after it is set to mature; he will have to rely on the production of a Cellar Master who lived a century ago to make his product today.

It is through the foresight and patience of previous Cellar Master’s, that production can continue today. Louis XIII is currently bottling a product made by men who lived in the late 1800’s, when the Gold Standard reigned supreme and Winston Churchill was a lad. I suspect that the master cognac makers of Champagne would make great crypto investors. It is against every human instinct, to make something, or make your mind up about something, and then leave it alone; to let it be so that it can come into its own, without your interference. In other words, it is a trait of greatness to be able to sacrifice your own drives and baser instincts for a greater outcome. In the case of cognac, for quality, and in the case of crypto for returns.

I suspect that in the recent downturn, many of you have felt the temptation, if not the overwhelming need, to liquidate some or all of your holdings. Fear is a powerful drive. And when crypto rebounds, you will be fighting yourself not to mortgage your house just to buy some extra Bitcoin and ride the bull wave. But when you feel these urges, I ask you to consider the Cellar Masters of yore at Louis XIII, the men who let the barrels sit through two world wars, the Great Depression, the Cold War, and the advent of changes and technology they could not dream of, they let the barrels sit through 100 years of “what ifs” and “I’m not sure we’re gonna get through this”.

What do you think would happen if you let your Bitcoin sit, just let it be without interference for the next 10 years? What about the next 20 or 30 years? Are you comfortable enough with your process, with yourself, and the cryptos you have chosen to invest in, to be able to make that decision and to follow through? LIke the Cellar Master, have you put in the work up front? Have you done everything you could to give your grape juice (crypto) the best odds of maturing without turning into vinegar? It is a sign of great things to come if you can settle your mind and decide to “close the barrel” and let your choices be for the next few years. If you have put in the work and combined that with high quality ingredients, you are likely to make something outstanding.